Shifting can be complicated, and getting the right documentation, such as a packers and movers bill for the claim, is a must for an easy experience. These packing and moving bills are important for getting reimbursement, insurance claims made, or corporate expenses reported.

Get in Touch :- For reliable Rehousing packers & movers bills with GST, accurate formats, & quotes, ensuring claims & GST compliance, trust us for smooth relocations.

A packers and movers bill is proof of the services provided in relocation local or domastic shifting. It is beneficial for

Reimbursement Claims:- Many employers offer relocation reimbursements, and you need to download a valid bill for processing a claim.

Insurance Settlements:- Insurance settlements bill helps make insurance claims easier in the event of damage or loss in transit.

Expense Management:- Perfect financial accounting and enforcement of tax rules depend on detailed downloaded bills. An example can be taken of an IT professional who is relocating from one city with their company's transfer policy and will require packers and movers GST bill to claim relocation costs. With the Packers and Movers company GST bill, his reimbursement could be completed on time.

We had a client who had detailed invoices of the movers and packers formate with GST charges, where itemized damages and transport costs were listed. Their insurance provider processed the claim in a week as the packers and movers Goods and Services Tax bill was very clear and very accurate.

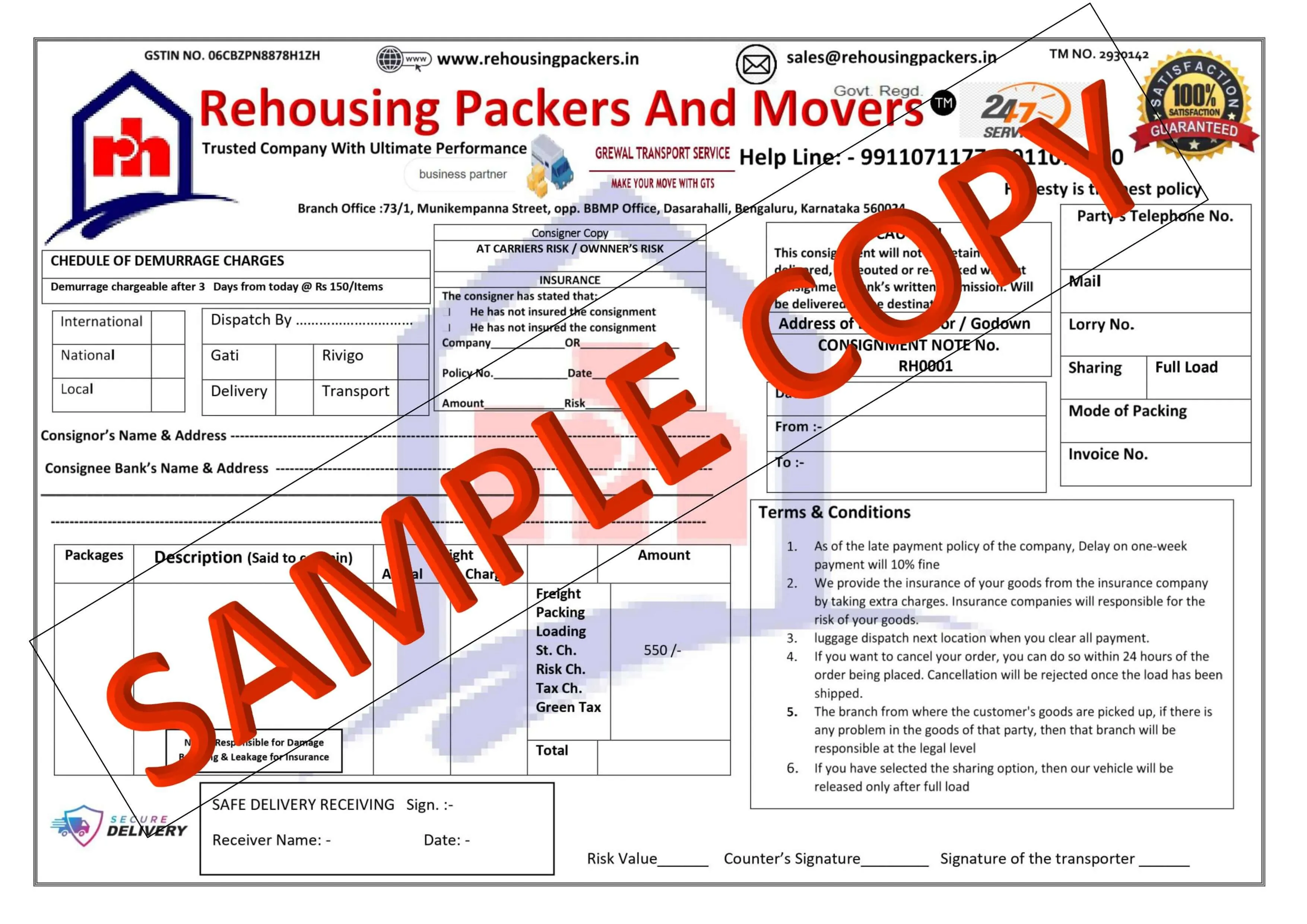

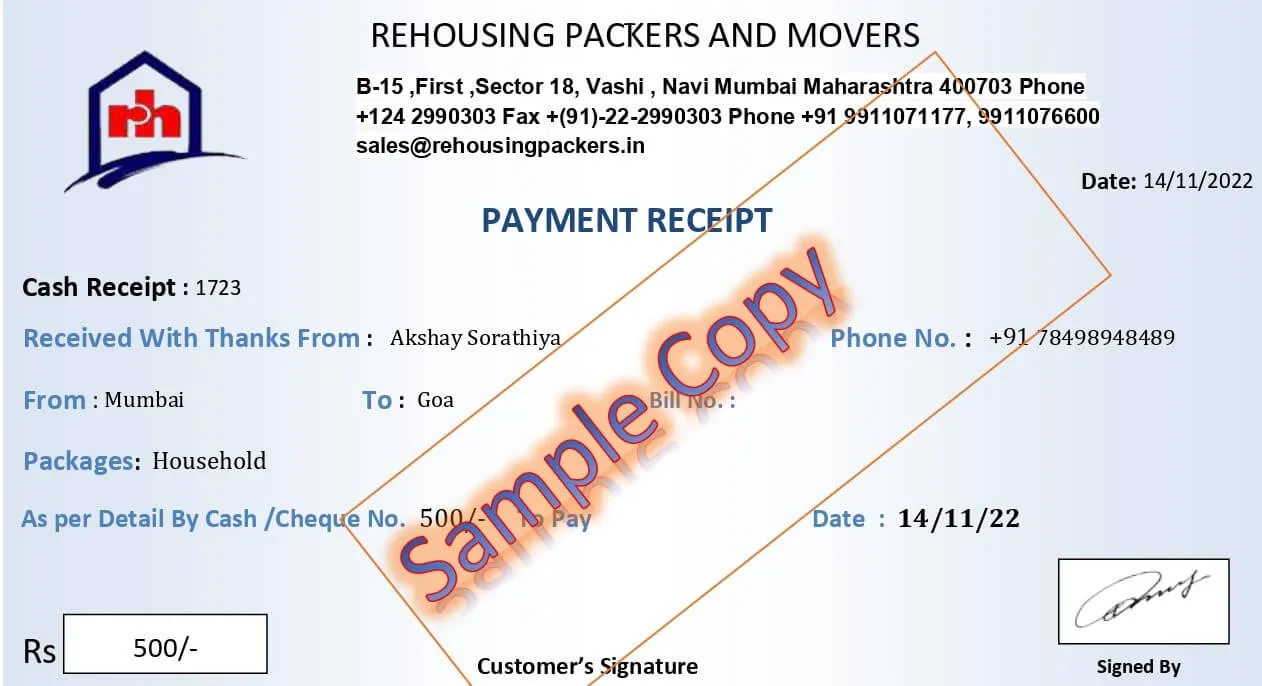

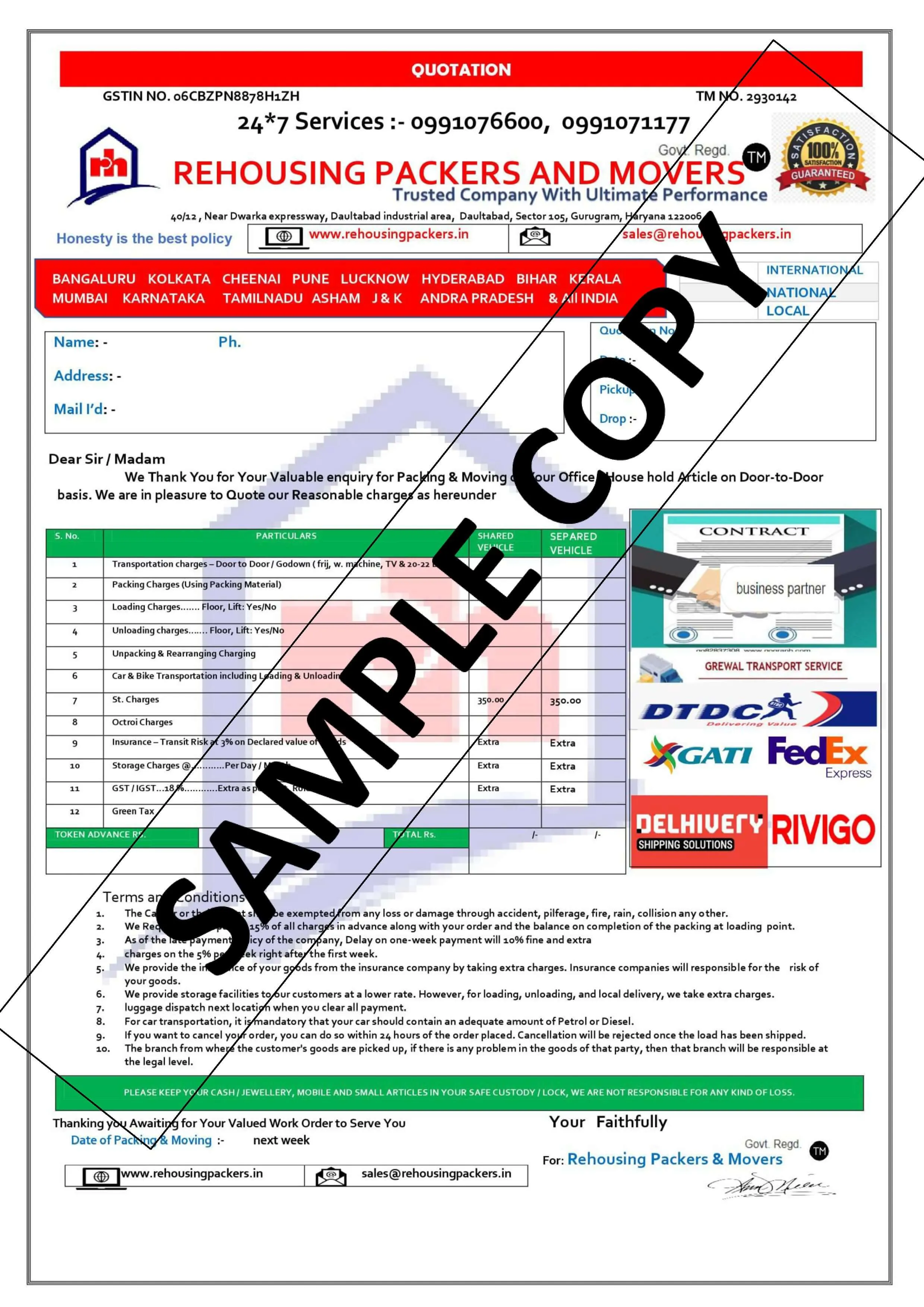

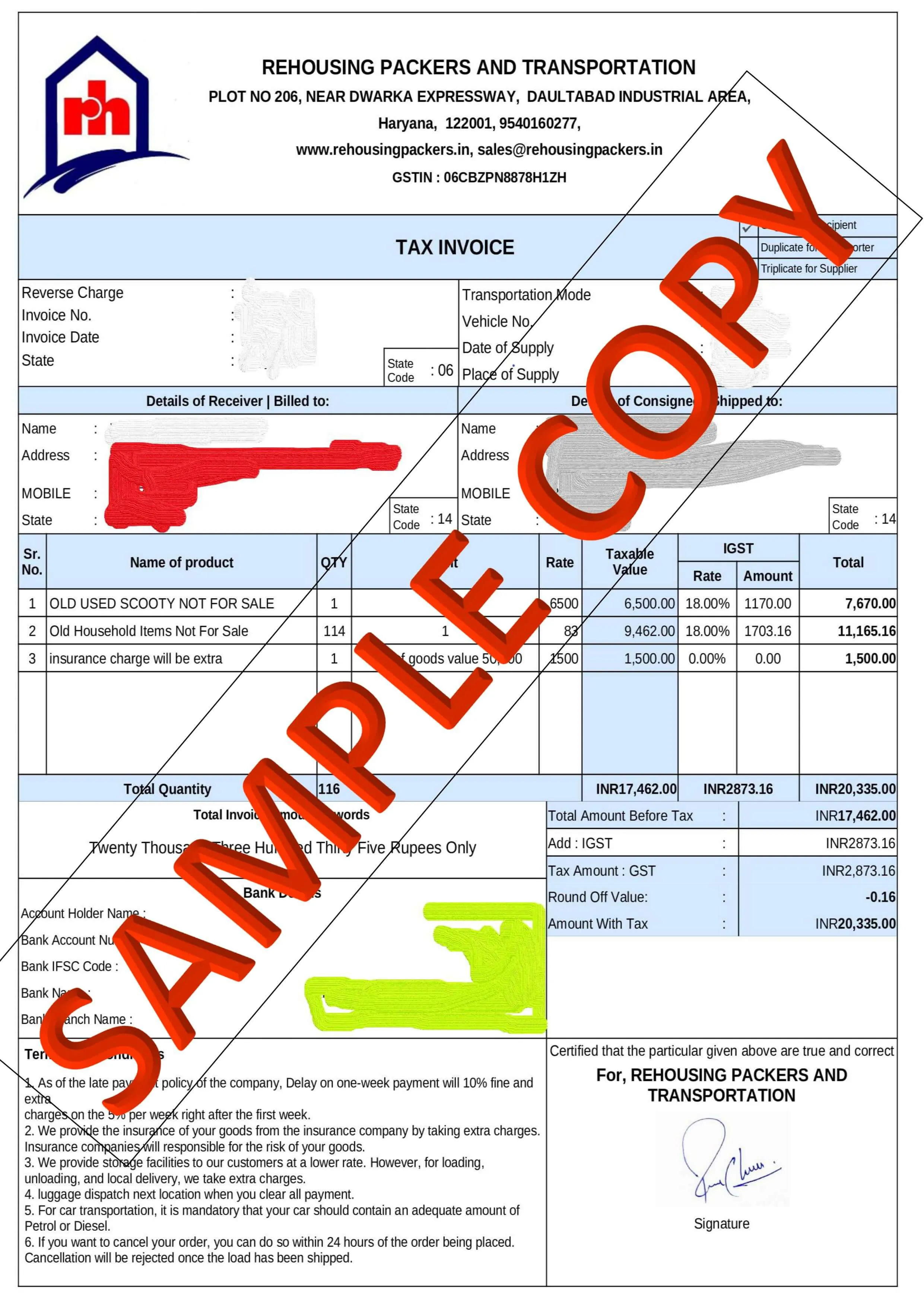

Below is a Rehousing download PDF template sample to understand what a professional bill should look like:

| Field | Description |

|---|---|

| Company Name & Logo | Details of the service provider |

| Customer Details | Name, address, and contact information |

| Service Description | Packing, loading, transport, unpacking |

| Itemized Charges | Detailed breakdown of costs |

| Tax Information | GST number, tax rates, and amount |

In case you understand the formats of bills, you will get the bills processed very smoothly. Some common types of Packers and Movers Bills are-

It is specifically prepared in GST format and as per tax and legal compliance standards. It includes:

Service Provider's GST Number:- The movers company bill is made effective legally as this ensures that the business is registered under GST.

Tax Breakup:- The packing and moving GST bills should mention CGST, SGST, or IGST accordingly as per the service provided by the transporter within a state or interstate.

Total Amount:- The customer should be aware of the total cost of the invoice inclusive and exclusive of GST.

Invoice Number and Date:- The movers company bill should have the invoice number and date, as these are mandatory fields for traceability and authenticity. It is especially important for corporations where companies encounter GST-compliant invoices for reimbursement.

For instance, a marketing executive who relocated for a new job paid relocation costs since their claim was compliant with GST regulations. Goods and Services Tax bills also often contain a breakup of the packing, loading, transportation and unloading charges. These details must be more transparent for speedy claims and to start the processes without delays.

A transport packers and movers bill template primarily deals with the transportation niche. For businesses that must claim or reimburse logistics-specific expenses, this format is essential. The key details included or prepared in this format include:

Vehicle Details:- The type of vehicle used (truck or van) and its registration number.

Distance and Route:- This requires clear documentation of the distance travelled, as well as a route followed to transport goods.

Transportation Charges:- Transportation charges are in the form of itemized transport-specific costs such as fuel, driver fees, tolls, etc.

GST Details:- GST applicable charges are included so that claims are compliant and valid.

Case Study: Efficient Claim ProcessingA manufacturing company wanted a bill specifically tailored to kickstart the costs of its new warehouse. Our company packers and movers template bill listed truck type, route travelled, and other costs of transport, which included tolls and fuel costs. The well-structured bill helped the finance team process the claim within three working days.

The original packers and movers bill sample copy is a comprehensive document that combines transparency and accuracy, ensuring hassle-free claims. A detailed packers and movers bill format that combines transparency & accuracy makes the process hassle-free. Here is what makes it unique.

Detailed Breakdown of Services:- An original bill itemizes in the format of a list which spells out item by item services rendered such as packing, loading, transportation and unpacking. Such a detailed breakdown of services ensures that every cost is included and no dispute comes up during processing.

Accurate Service Dates:- Credibility is maintained when a bill has details that include precise service dates of service rendered. Take, for instance, a corporate employee who relocates for a short time and can make use of the bill as the grounds for submitting the bill for reimbursement claims.

Professional Presentation:- A well-formatted bill includes the name of the company, its contact details, and its registration number. It increases trust and demonstrates the professionalism of the service provider.

Transparent Charges:- Transparent charges mean the original packers and movers bill clearly states all the costs, labour, materials, and transportation. For example, if a family is moving interstate, they can get a bill based on the vehicle used and manpower required, which keeps the billing process transparent.

Compliance with Legal Standards:- The original packers and movers bill follows legal provisions like GST laws. This is particularly important for businesses that need tax-compliant invoices to claim GST input credits.

Customer Details:- The recipient's name, contact address, as well as details must be included in the bill so that it is personalized and traceable. With these elements in place, not only do transport service providers like Rehousing Packers and Movers facilitate smooth claims, but they also illustrate their commitment to transparency.

Case Study - Bill DetailsBill Details Our customer was a newly hired software developer going from Pune to Bangalore who had to have an original bill to justify his company's treasurer's approval of their company's relocation reimbursement.

We provided the transport packers and movers bill format to him with proper GST details and the detailed breakdown of packing, transport, and unloading costs on the bill that helped him claim his transport expenses without delay.

It is an invoice that combines tax details and complies with legal requirements so that corporate and individual users can use it.

Key Features of a Valid Packers and Movers BillA professional movers and packers bill should include the following:

1. Company Details: Name, address, and contact information

2. Service Description: Packing, transportation, unpacking, etc

Itemized Costs: Clear breakdown of all charges

Tax Information: GST number and applicable taxes

This way, a packers and movers bill generator helps you avoid errors and disputes involving GST laws.

The following benefits can be derived from an accurate packers and movers bill that include

Claim Processing:- Bills that are accurate make reimbursement and insurance claim processes easier and faster.

Legal Compliance:- Providing GST details makes sure of Compliance with taxes and validity.

Transparency:- Through itemized charges, you can provide transparency that, in turn, builds trust in your customers.

Statistic: Claim EfficiencyAs per a statistical survey, an invoice supporting relocation claims, when prepared in a detailed format and an accurate manner, results in 78% of relocation claims being approved faster.

Cross-Verify Details:-Make sure to double-check the GST number, company details, and invoice amount.

Request a Copy:-Keep a packers and movers bill copy for your records.

Choose Reliable Providers::-Choose reputed companies such as Rehousing Packers and Movers that provide professional documentation.

Your bike is handled with utmost care using specialized equipment and trained professionals.

Competitive pricing with no hidden charges. Price match guarantee for bike transport.

We serve all areas and across India with reliable bike transport services.

Our customer support team is available round the clock to assist you.

Good packers and movers' bills are needed to get faster claims. If you understand the nuances of the transport packers and movers bill or the format of movers and packers' invoice with GST, then it becomes easier to get your reimbursement or claims.

However, it's always better to go by the fact of accuracy and never take chances with untrusted service providers. You need to check out by going through more resources and templates to help make your relocation as stress-free as possible.

Be it creating packers and movers bill for claim template or validating packers and movers Goods and Services Tax bill format, and with proper documentation you can increase the chances of your claim success rates.

Thanks to Rehousing for providing a packers and movers bill with GST. It made my claim process smooth and hassle-free!

The packers and movers bill format from Rehousing was clear and concise, No hidden charges, just great service!

The packers and movers GST bill format from Rehousing was perfectly detailed, ensuring a clear understanding of charges.

A Packers and Movers bill for a claim is an official invoice issued by the service provider detailing the relocation services provided. It is used for reimbursement, insurance claims, or corporate expense reporting.

GST compliance ensures the bill is legally valid and meets tax standards. It is especially important for businesses and individuals claiming GST input credits or corporate reimbursements.

A valid bill should include the company name, contact details, GST number, detailed service descriptions, itemized costs, and tax breakdowns (CGST, SGST, or IGST).

Yes, an itemized bill with accurate service descriptions and costs is crucial for processing insurance claims in case of damage or loss during transit.

A GST Bill is specifically formatted for tax compliance, while an Original Packers and Movers Bill includes detailed service descriptions and is more comprehensive for general claims or reimbursements.

Companies require GST-compliant bills to ensure the documentation is valid for tax purposes and to process relocation reimbursements smoothly.

Cross-verify details such as the GST number, company information, itemized charges, and total amounts. Always choose reputable providers for professional documentation.

Accurate bills facilitate quicker reimbursement, ensure legal compliance, and build trust through transparency in charges.

Yes, templates provide a structured format and help ensure that all necessary details, like service descriptions and tax information, are included.

An itemized bill provides a clear breakdown of all costs, making it easier to validate and process claims without disputes or delays.