U63031HR2022PTC105105

06AAMCR0254J1ZA

RTKR17461D

AAMCR0254J

UAM No. HR05E0020837

PSA/REG/GGM/LI-6/0140477

332106

Registered under Class 39 | Trade Mark No. 5664141

Rehousing Packers Private Limited is a legally registered logistics and relocation company operating across India. We are a GST compliant, trademark registered and government authorized packers and movers company ensuring safe, reliable and professional shifting services.

Rehousing Billl For Claim in Hyderabad offers detailed billing solutions for both individuals and businesses. With a commitment to transparency and compliance, the company ensures each bill includes a detailed breakdown of services rendered, thereby providing clarity for claims and record-keeping. Every bill is GST-compliant, accurately reflecting the current GST rates to facilitate tax deductions and financial planning for clients.

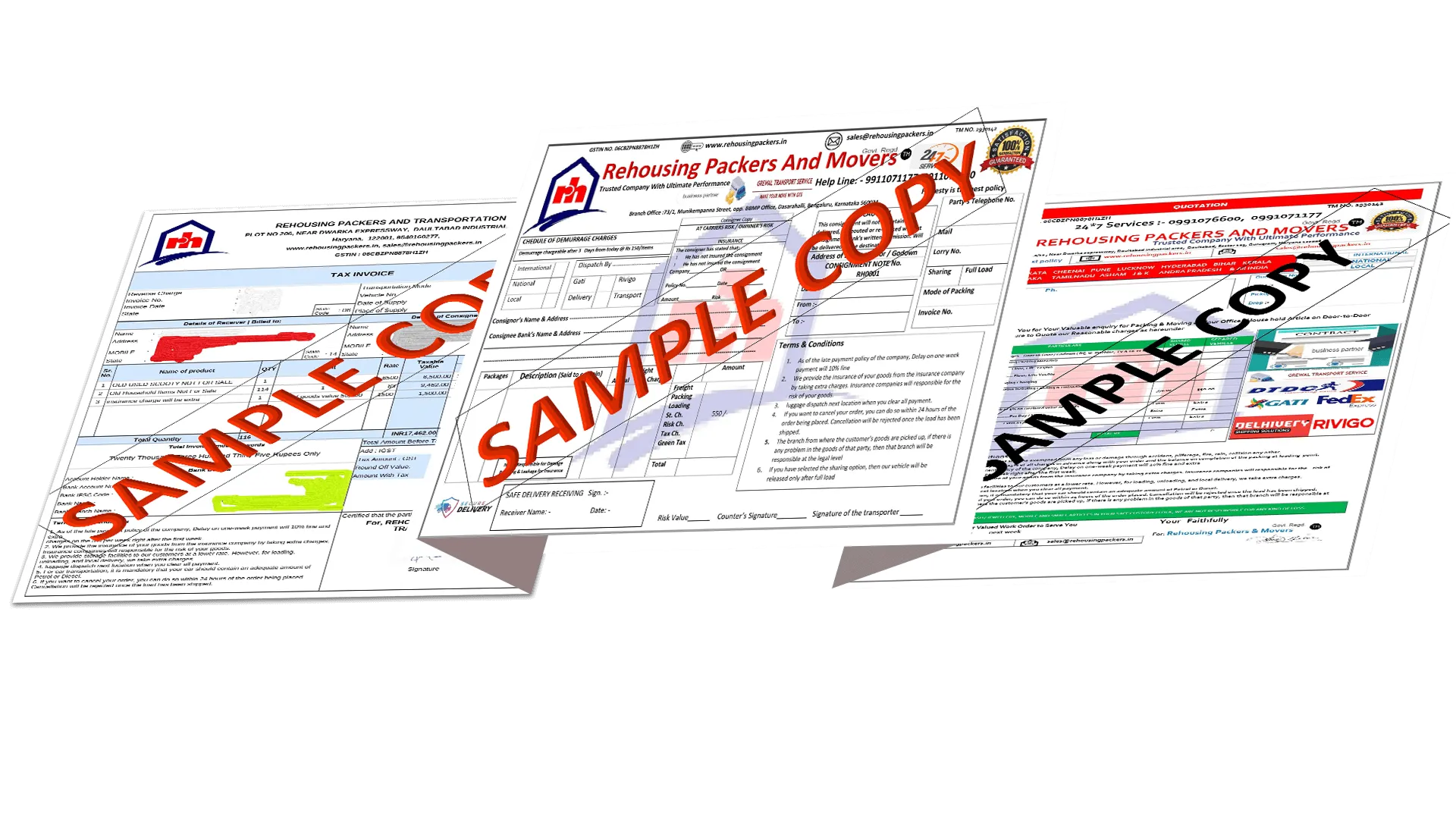

Rehousing Billl For Claim in Hyderabad provides a variety of bill formats, including PDF and Word, to cater to the diverse needs of its clients. These formats encompass packers and movers quotations, GST bills, transport invoices, and shipping bills, all designed for ease of understanding and efficiency.

The company’s documentation strictly adheres to the latest financial regulations, offering a transport tax invoice format and a logistics bill format that meet legal requirements. This systematic approach to billing ensures that clients in Hyderabad can easily claim expenses or manage their relocation budgets effectively, reinforcing Rehousing Packers and Movers' commitment to customer satisfaction and regulatory compliance.

Get in Touch :- For reliable Rehousing Packers & Movers bills with GST, accurate formats, and transparent quotes, ensuring seamless claims processing and GST compliance, trust us in Hyderabad for smooth relocations.

Rehousing Bill For Claim in Hyderabad provides professional and smart moving solutions. We focus on using technology to make our work better and always aim to make our customers happy. With years of experience setting benchmarks in the industry, we specialize in the packing and moving of household goods, cars/personal vehicles, office equipment, computer systems and data storage devices, pets, furniture, electronic and electrical goods, as well as fragile items and glassware.

Clients in Hyderabad are encouraged to contact us for claims on movers and packers bills. Thanks to our well-trained and capable workforce, we guarantee the timely and budget-friendly completion of projects of any size, highlighting our effectiveness in the relocation sector.

Reach us via phone or online form to discuss your transport requirements.

Receive a free estimate based on load size, distance, and required services.

Confirm your booking and choose a suitable date and time for pickup.

Premium packing materials ensure maximum safety during transit.

Well-maintained 17ft, 22ft & 32ft trucks ensure safe delivery.

We unpack and place items according to your preference.

Complete inspection ensures all goods are safely delivered.

Your feedback helps us improve and deliver better service.

You must contact a reputable packers and movers to move your goods. Select a reliable, legally operating, and licensed movers and packers for IBA approved transport bill.

When using essential services, verifying the auto transporter's licence, transportation permission, GST registration certificate, and firm registration certificate is a great choice. Please bear in mind that only a legitimate and trustworthy business, such as Rehousing packers and movers can guarantee your goods's secure and hassle-free delivery.

You must be aware of any paperwork required when your goods are transferred. To ensure safer, simpler, and hassle-free goods movement. You may adhere to particular regulations and produce copies of specific documents.

You could require papers proving your identity, proof of auto insurance, proof of vehicle registration, and more. Therefore, you must have copies of these documents on hand when intending to relocate your vehicle so that you can present them as needed.

You must contact a reputable packers and movers to move your goods. Select a reliable, legally operating, and licensed movers and packers for IBA approved transport bill.

When using essential services, verifying the auto transporter's licence, transportation permission, GST registration certificate, and firm registration certificate is a great choice. Please bear in mind that only a legitimate and trustworthy business, such as Rehousing packers and movers can guarantee your goods's secure and hassle-free delivery.

You must be aware of any paperwork required when your goods are transferred. To ensure safer, simpler, and hassle-free goods movement. You may adhere to particular regulations and produce copies of specific documents.

You could require papers proving your identity, proof of auto insurance, proof of vehicle registration, and more. Therefore, you must have copies of these documents on hand when intending to relocate your vehicle so that you can present them as needed.

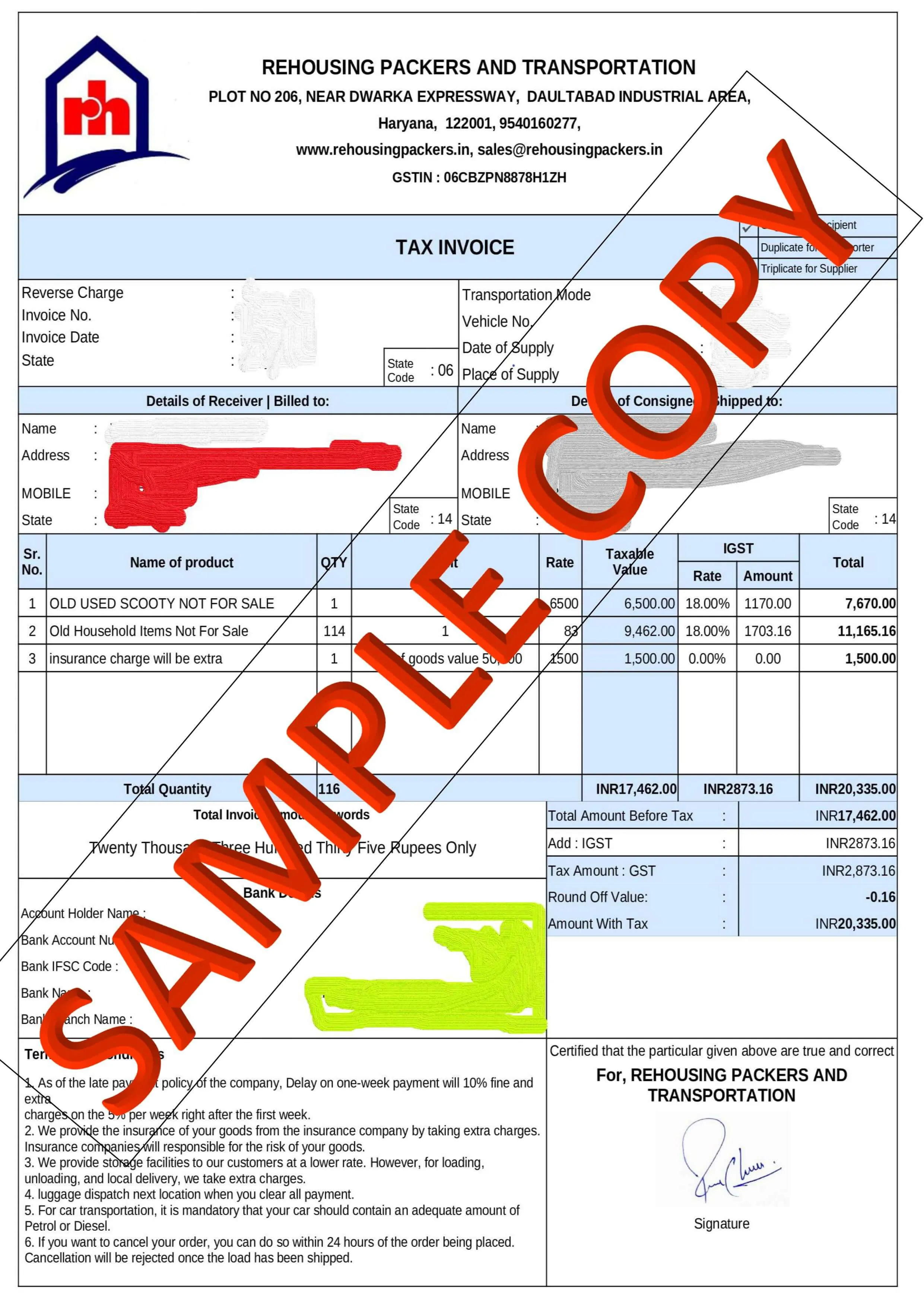

The packers and movers gst invoice is one of the most essential aspects that most clients overlook. To claim the movers and packers GST bill, you'll need all of the bill's documentation, including the GST invoice, payment money receipt, and household items transport bill. Aso crosscheck if that bill is the original one, not the fake transport bill. To claim the bill you must need a packers and movers GST Bill Format, where you can check what are the actual charges for each individual service. There are so many packers and movers in the market but that does not mean all are genuine, we should always make sure if they have IBA approved bill format available.

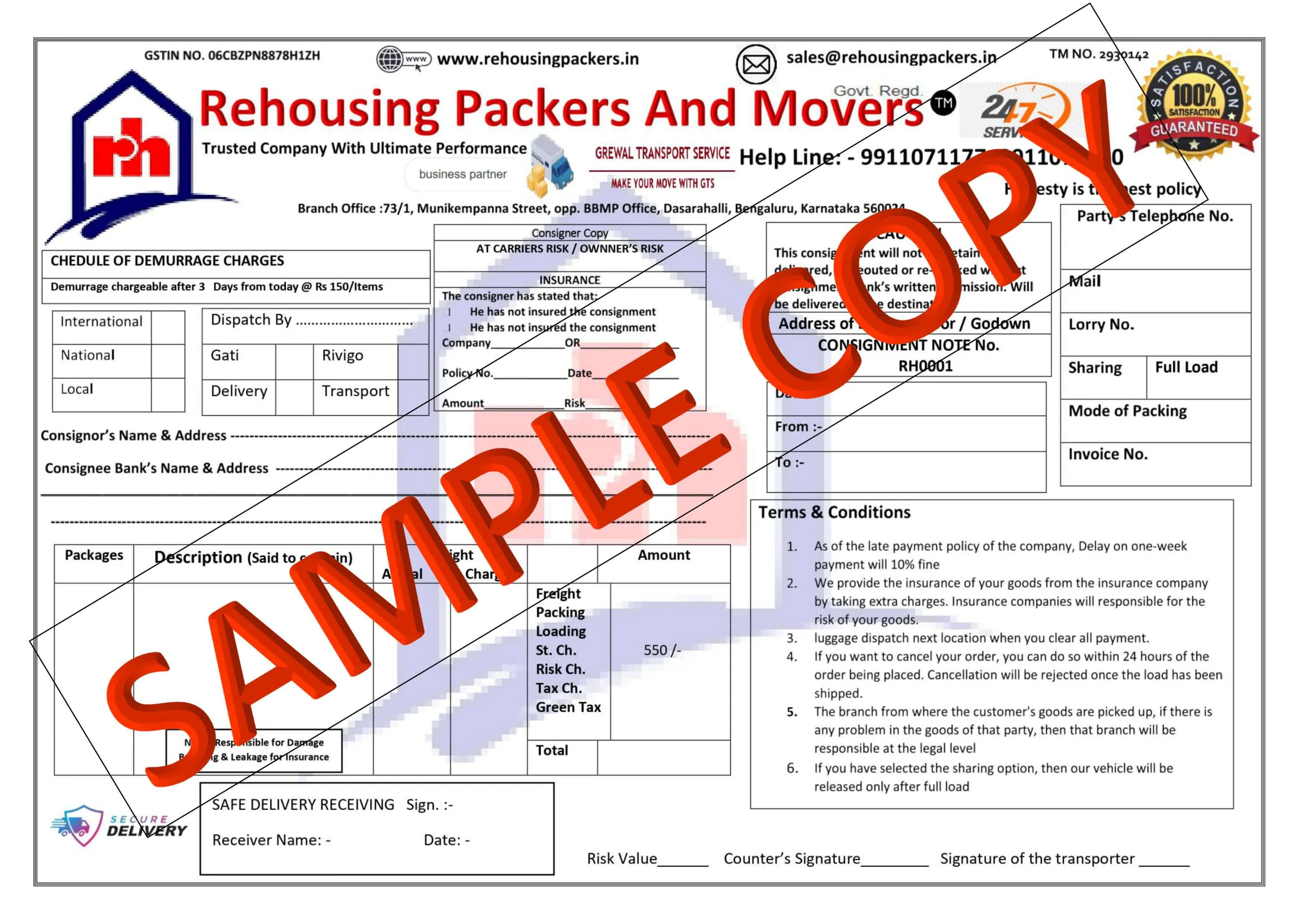

✔Consignment copy

✔Industrial Shifting

✔Genuine bill/Invoice with GST Stamp (Bill Invoice with GSTIN Number)

✔List of articles (Packing List or Inventory copy)

✔Transit insurance papers

✔Cash receipt if needed

What should you think about when getting a bill for claim packers and movers?When you have decided on packers and movers to provide you with a packers and movers bill for claim, keep the following factors in mind.

✔100% legitimate method of relocation bill generation

✔Valid and verified Bill of packers and movers with GST No.

✔You receive a hard copy of packers and movers Bill to submit in your company

✔Very straightforward method to claim your movers and packers bill

How can I get the detailed packers and movers GST bill formatRehousing packers and movers are unaware of this and just charge the consumer 0%, 5%, 12%, 18%, or even 28 percent GST without even having a GST number. The taxation of moving services has altered since the introduction of the GST system in India on July 1, 2017. In this post, we'll look at how GST affects packers and movers bills, as well as how the new taxing structure affects clients' wallets.

In India, the goods and services tax (GST) was implemented on July 1, 2017, with five different slabs. 0% GST on packers and movers bill or relocation billThis slab, also known as the Reverse Charge Mechanism (RCM) is applicable under which the recipient declares that they would pay the GST directly to the Indian government. In this scenario, the recipient must have a GST number. If a consumer simply uses transportation services. They will be charged a flat rate on packers movers bill and relocation allowance bill.

Some packers and movers may offer "cargo transfer" as a relocation service. In that instance, the GST rate on services will be 5%. Unless you choose to use simply the transportation services, the typical GST rate for packers and movers is 18%. This is where most consumers become perplexed, as they begin to believe that the movers and packers GST bill is 5%, which is not the case.

Rehousing packers and movers is a hybrid service that incorporates a variety of services such as labour, transportation, and storage . This is why, after considering all of the services, an 18 percent tax rate was chosen. If you elect to use multiple service providers for different services, the tax will be calculated proportionately.

For example, if you handle all of the packing and loading yourself and merely hire transportation, you'll have to pay 5% gst on the charge. However, if you're also getting packaging, loading, unloading, and other services in addition to household items and transportation bills, you'll have to pay 18% gst. The insurance company will not process the claim if the gst is charged at 5% on the invoice value, citing a documentation issue.

We recommend that you hire the best packers and movers so that you can relax during and after your transfer.

What documents are required when you claim your movers and packers bill?The following documents are required when you are claim packers and movers bill :-

Consignment Copy :- This is a document for the consigner who received the items at the destination. The document is duplicated four times. Copy of the consignee, copy of the consignor, copy of the driver, and copy of the office. All information such as name, address, phone number, Consignment number, terms and conditions, and item number is included. Bulty is another name for this. This is the primary transportation document.

Item List :- The most significant document for claiming your bill from your office is the item list. The packers and movers bill's value is determined by the item list. This is an important document for insurance purposes. You may also use the item list to examine or count the products when the packers and movers company unloads the household at your location.

Print the GST on the bill :- This is the most important document to submit when filing a claim. Packers and movers charges, transportation charges, loading, unloading, rearrangement, tax, and insurance will all be listed separately here. It's critical to double-check the GST number on the bill.

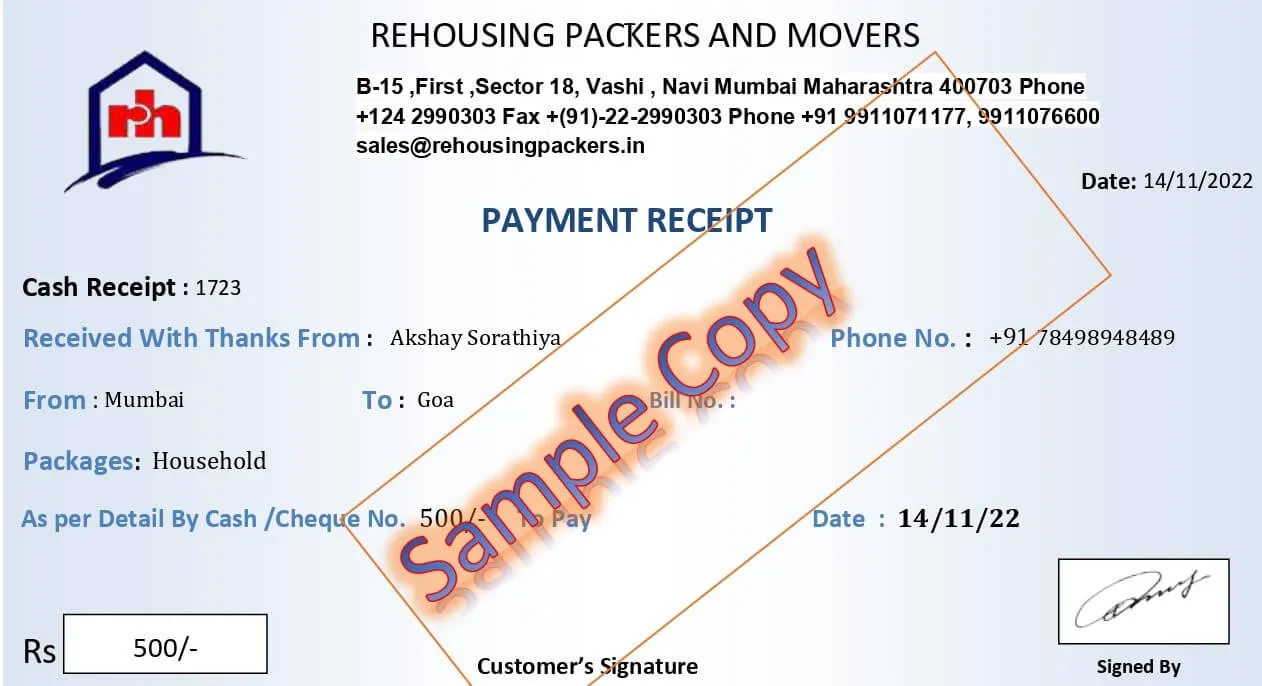

Receipt of Funds :- When you pay in cash, you will receive this copy. This paperwork will be sent to the moving and packing business. Check out the GST number.

Packers and movers fake bills may be a forgery if it lacks any of the required information. For example, it would be regarded as a fraudulent invoice if a trader issued a transport GST invoice without a GSTIN. A fake packers movers bill invoice format shall be considered a fake invoice if a firm is not registered for GST but puts a phoney GSTIN on the invoice and charges GST. The tax paid will not be deposited with the government.

Every taxpayer gets a unique GSTIN that is 15 digits in length, based on their PAN. If the structure of this number changes in any way, it can readily be recognised as a fake transport bill. However, just because a GSTIN is formatted correctly does not indicate that it is genuine or belongs to the company issuing packers and movers invoice.

Typically, packers and movers offer five services : dismantling, packaging, loading, and transportation and unloading because various rates apply to different moving services. If you are merely using transportation. You will only have to pay 5% GST on packers and movers gst invoice. In the event of loading, unloading, and packaging, labour and packaging materials are required and the GOI requires 18 percent GST.

12% GST on movers and packers bill or transport bill invoiceWhen a corporation receives transportation services, 12 percent GST is applied. Remember that just transportation is covered in this scenario. If a business uses other services such as dismantling, packaging, or loading/unloading in case of house shifting bill format , GST will be applied at 18% of the entire cost.

18% Gst on packers and movers invoiceFor entire packers and movers invoice s, including disassembly, packaging, loading, unloading, shipping, and insurance, your GST bill must be 18 percent. According to the Indian government, the appropriate GST rate is 18%. As insurance firms, this provides you with an additional benefit.

28% gst on movers and packers invoice

Luxury commodities such as gold and silver, as well as high-end fashion clothes are subject to a 28 percent GST. It is against the GST laws for a packers and movers service provider to charge you 28% GST.

An IBA approved packer and mover services provider will constantly advise its clients so that the billing is done in accordance with the government of India's rules. The customer's interests are also safeguarded as the insurance claim comes in useful in the event of any unforeseen circumstances.

Your bike is handled with utmost care using specialized equipment and trained professionals.

Competitive pricing with no hidden charges. Price match guarantee for bike transport.

Our customer support team is available round the clock to assist you.

All service providers are background-checked and fully verified.

Your goods are protected with comprehensive transit insurance.

Thanks to Rehousing for providing a packers and movers bill with GST. It made my claim process smooth and hassle-free!

The packers and movers bill format from Rehousing was clear and concise, No hidden charges, just great service!

The packers and movers GST bill format from Rehousing was perfectly detailed, ensuring a clear understanding of charges.

A packers and movers bill for claim is a document issued by the service provider in Hyderabad that serves as proof of the relocation services availed by a customer. This bill is essential for individuals in Hyderabad looking to claim relocation expenses from their employers or for tax deduction purposes. It includes details such as service charges, GST (Goods and Services Tax), and other applicable fees.

GST on packers and movers services in Hyderabad is applied according to the standard rates set by the government for transport and logistics services. As of the last update, this GST rate may vary but is typically around 18% for most packers and movers services in Hyderabad. This rate is subject to change based on government policies.

A packers and movers bill with GST in Hyderabad should include the service provider’s name and details, customer’s name and moving details within or outside Hyderabad, a detailed list of services provided (like packing, transportation, loading/unloading), the total cost before GST, the GST amount (clearly showing the GST rate applied), and the total amount due including GST.

The format of a packers and movers bill in Hyderabad typically includes a header with the service provider’s information, a section for customer details, service date(s), a detailed breakdown of services offered and individual charges within or to/from Hyderabad, the total amount before taxes, applicable GST, and the final total. Additional sections may include terms and conditions, payment details, and signature fields.

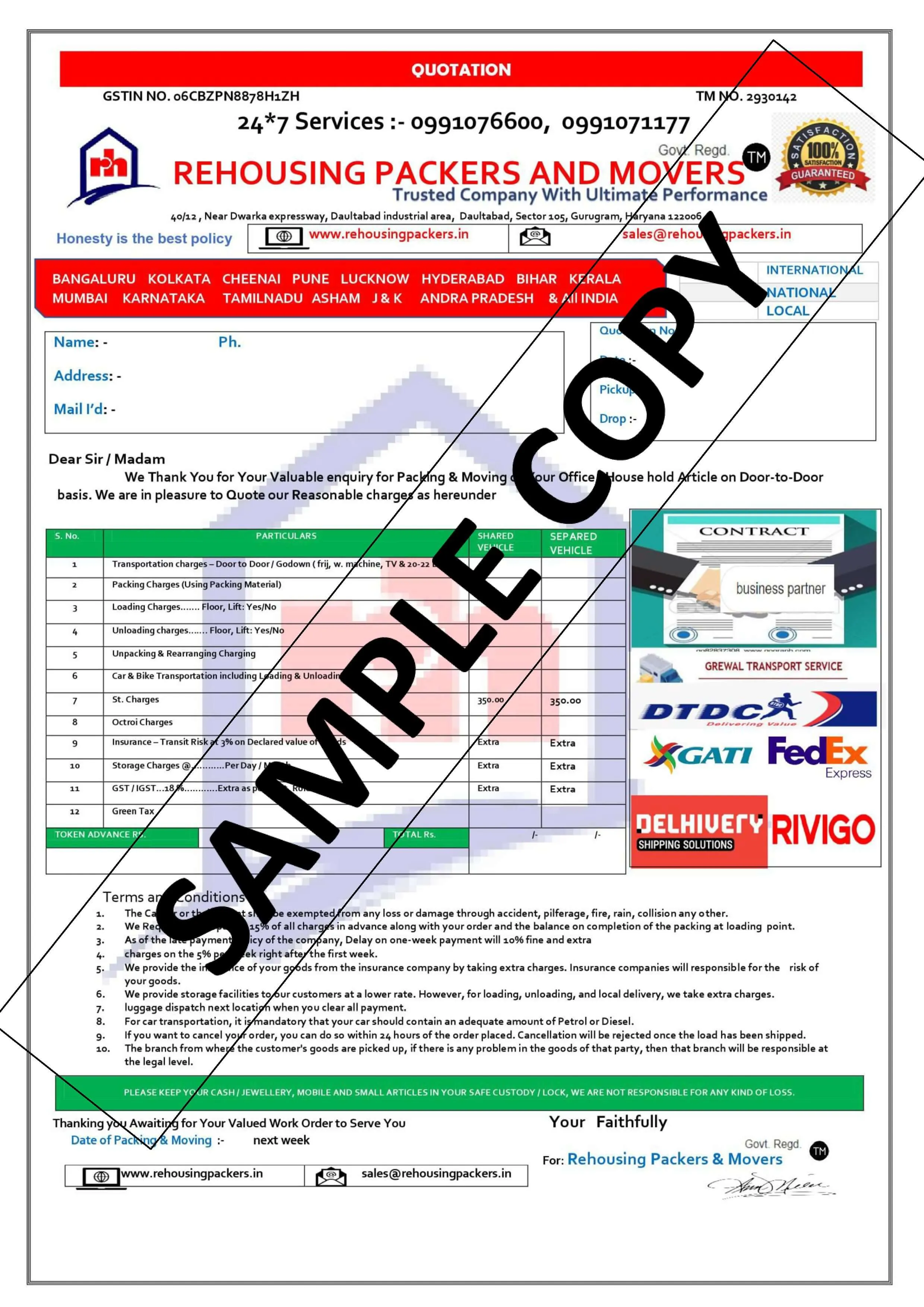

A sample quotation format for packers and movers in Hyderabad includes the service provider's details at the top, a quotation number, and date. It is followed by the client's information, a detailed list of services to be provided with individual cost estimates (like packing materials, labor, transportation to or from Hyderabad), total estimated cost, applicable GST, and total estimated cost including GST. Notes about terms and conditions, validity of the quotation, and payment terms are typically at the bottom.

Packers and movers in Hyderabad use a GST bill format that complies with the standard invoicing requirements under the GST law. This includes the service provider’s GSTIN (GST Identification Number), place of supply in or outside Hyderabad, HSN (Harmonized System of Nomenclature) or SAC (Services Accounting Code) codes, detailed service charges, GST rate applied, and the total amount including GST.

The GST rate for packers and movers services in Hyderabad generally falls under the 18% category, which applies to most transportation and logistics services. However, it's crucial to check the latest GST rates as these can be updated by the tax authorities.

Packers and movers bill PDFs in Hyderabad can often be downloaded from the service provider's website or requested directly from the company. Some providers in Hyderabad also send the bill via email in PDF format for convenience and record-keeping.

A transport bill format in Hyderabad includes the transporter’s details, consignor and consignee information, details of the goods transported (including weight, type, and quantity) within or outside Hyderabad, transport charges, any additional charges, the total amount before taxes, GST details, and the total payable amount including taxes.

A packers and movers quotation format in Word for Hyderabad should include the service provider’s contact information, the customer’s details, a detailed list of services to be provided with individual pricing (packing, loading, transport to/from Hyderabad, unloading, unpacking), any additional services, the total estimated cost, GST applicable, and the total estimated cost including GST. It should also outline terms of service, payment terms, and validity period of the quote.